With the opening of the Free Application for Federal Student Aid (FAFSA) last month, financial aid season officially commenced on college campuses across the country as enrollment professionals focus on driving applications while touting the affordability of their institution. With some profound trepidation around the economy — the potential for a recession, surging inflation and ongoing political upheaval — students and their parents are searching for ways to make a college education more affordable.

In the recent 2022 Niche Senior Enrollment Survey, four out of five responders said they did not apply to a school if it was too expensive. Attitudes like these have some asking if we are experiencing a college affordability crisis.

That means it’s more important than ever for your institution to understand how families feel about college affordability issues, how they are navigating the financial aid process, and how you should be promoting your institution’s value and affordability.

In a recent Capture Higher Ed webinar, Capture Senior Enrollment Advisor Derek Hartl and I welcomed special guest Edward Recker, director of relationship management at Sallie Mae, to discuss the recent results of Sallie Mae’s report, How America is Paying for College, as well as the company’s College Confidence: What America knows about paying for college survey.

We also offered some strategies and pro-tips on how you can promote affordability to future students and their parents.

Is College Worth It?

There is plenty of anxiety in the marketplace around going to college. Students and their parents are asking tough questions, like: Is it worth it? Can I afford it? Can I survive and thrive in the college environment?

With the FAFSA open, enrollment teams, university marketing specialists, and financial aid offices are trying to ensure that every student who applies to their college can answer those questions. As Institutional Student Information Records (ISIRs) start to arrive on campus, the pressure mounts with considerations like:

- How are students and their families investing in their future? The recent economic downturn has not helped. How does inflation affect higher education? Every indication is that families will be stretching every dollar this coming year to make college affordable.

- What is the current mindset of families as they begin their financial aid journey? For some, this journey started when a family started saving for college a long time ago. But for many others, college is just now coming into reality for their child. How are they dealing with this somewhat stressful yet exciting time?

- How can institutions get the right accessibility and affordability messaging to the right people during the financial aid journey?

As we start looking at how families are navigating this journey, it is important to understand how families are weighing college as well as the amount of stress they are feeling.

The objectives of Sallie Mae’s College Confidence: What America knows about paying for College survey are to measure high school families’ understanding, perceptions, and misconceptions about college financing and what college-bound students and parents know about financial aid, the FAFSA, scholarships, and student loans.

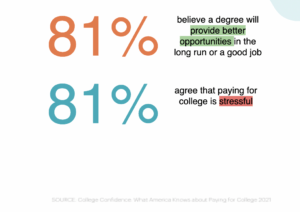

The good news for institutions: According to the survey, students believe that college is a path to opportunity; 81 percent believe a degree will provide better opportunities in the long run or a good job.

SOURCE: Sallie Mae’s College Confidence: What America knows about paying for College

“We keep hearing that there’s a decline in perceived confidence in the value of higher education,” says Edward Recker, the director of relationship management at Sallie Mae. He is a 20-year veteran of financial aid and higher ed and primarily works with high schools and high school counselors to elevate student interest in and knowledge of higher education — specifically how to pay and plan for higher ed. “But our study would indicate that a vast majority of high school students still believe a degree will provide better opportunities in the long run or lead to a good job.”

The bad news for institutions: 81 percent of families agreed with the statement that they are stressed out about education financing. Forty-six percent of respondents say they strongly agree with that statement; 35% somewhat agree with the statement.

“So, we’re seeing this interesting duality where folks still believe in higher education, but they’re really stressed out about how to pay for it,” Recker says.

A Willingness to Stretch Financially

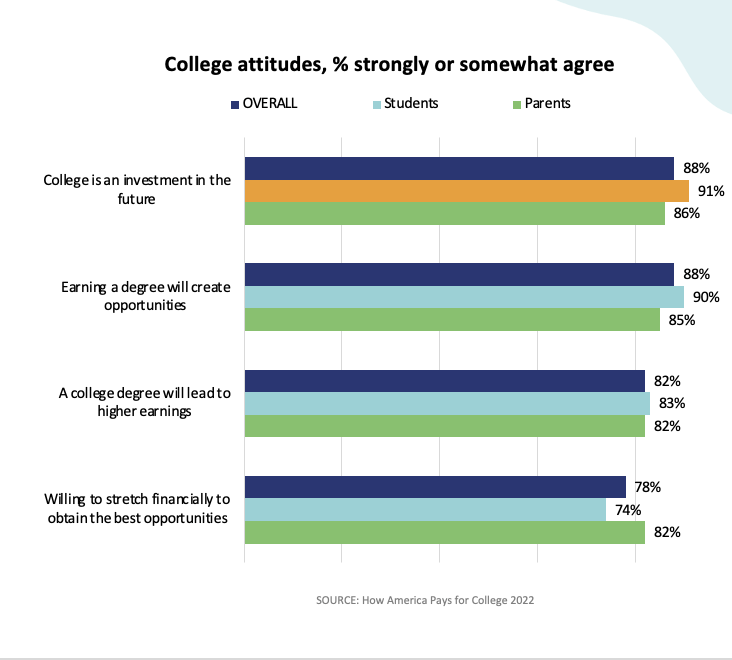

In its 15th year, Sallie Mae’s report, How America Pays for College 2022, surveyed American families with an undergraduate student about their attitudes toward a college education and how they pay for it.

According to this year’s report, families are willing to stretch themselves to make a college education a reality. A vast majority of college students and parents agree that a degree will create opportunities and lead to higher earnings, and eight in 10 are willing to stretch financially for a college education.

Is Perception Reality?

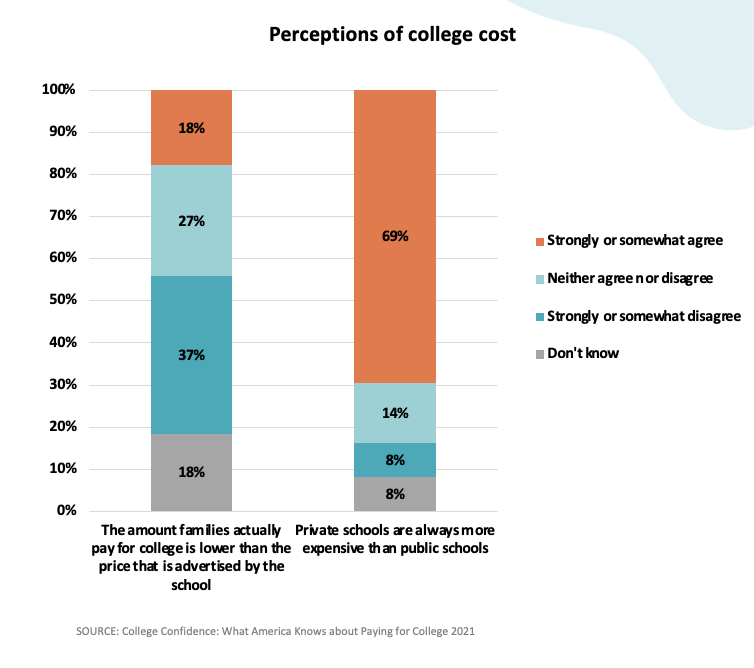

Some say perception is reality. If that’s the case, what families don’t know can have a major effect on their enrollment decisions. According to Sallie Mae’s College Confidence survey, college-bound families make some unfortunate assumptions about the cost of college.

For example, just 18% of high school students and parents think the amount families actually pay for college is lower than the price that’s advertised; 69% believe private schools are always more expensive than public schools.

Early Messaging to Avoid Early Elimination

Distance from home … Academic major … Campus culture … Athletics … Tailgating … We know several factors go into a student and their family making their college choice. But cost continues to be a major concern for families during the process.

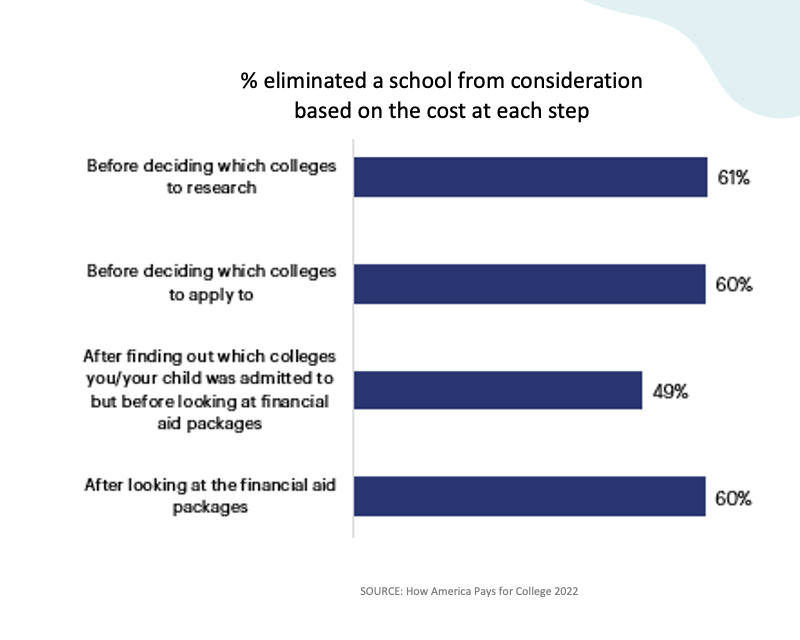

In fact, Sallie Mae’s How America Pays for College report found that 81 percent of undergrad families say they eliminated a school from consideration based on cost at some point between deciding which colleges to research and which to attend.

This seems to imply that families are ruling out applying and visiting certain institutions even before filing the FAFSA or talking with anyone at the university.

This emphasizes the importance of getting information to these families about the affordability and value of your institution earlier in the process. With the search now becoming more prevalent in high school sophomores and juniors, universities must beat the drum about their value and affordability earlier and more often.

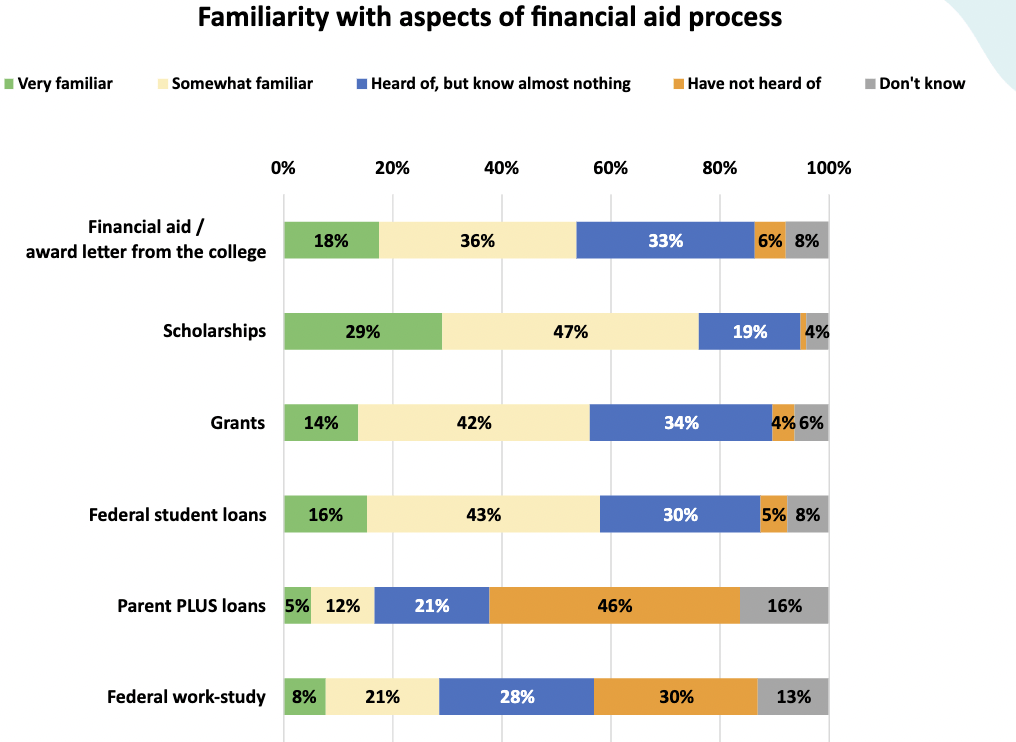

Financial Aid Familiarity

One thing we learned from Sallie Mae’s College Confidence Survey: What America knows about paying for college is that high school families don’t know much about the financial aid process. And, not surprisingly, families in which the student will be the first to attend college are significantly less familiar with the process than families with college experience.

SOURCE: Sallie Mae’s College Confidence: What America knows about paying for College

This is something we should be addressing as an industry and yet we still find it hard to help families connect the dots. The process itself has changed. Thirty years ago, a family had to complete the FAFSA by hand and often needed the help of a tax preparer.

Over the years, the process has been simplified but still, to this day, we have a hard time communicating and reaching families about this process. How do you educate your prospective students and their families about the forms of aid? How do you remove the burden of the financial aid process?

Three Solutions

Now that we’ve exhausted the pain, it’s time to look at three quick and easy solutions for institutions that want to help families navigate the financial aid process seamlessly and with as little stress as possible.

No. 1 – Identify Influencers: Whom do you need to connect with? Who are the influencers?

There is so much noise out there and it’s not going to get any better. Smaller graduating classes mean more competition. We have midterm elections coming up, not to mention the 2024 election cycle, so email and regular mailboxes are going to be filled with junk. Social media and digital advertising are going to explode with noise as well.

You must get your messages about affordability to your prospective students’ influencers. It has never been more important for colleges and universities to have a universal message and talking points for:

- Prospective Students

- Parents/Guardians

- Guidance Counselors

- Transfer Counselors from other schools

- Your Current Students

- Your Admission Counselors

- Your Financial Aid Staff

Pro Tip: Your current students, faculty and staff have an enormous amount of influence. Make sure you are on the same page with them!

No. 2 – Explore Communication Channels: Meet prospective student needs where they are in their enrollment journey.

When you explore the different ways to communicate with prospective students — and those who have some influence over them — we think of it as a journey. When it comes to how you approach affordability and value statements, they slightly change as the student walks through this journey.

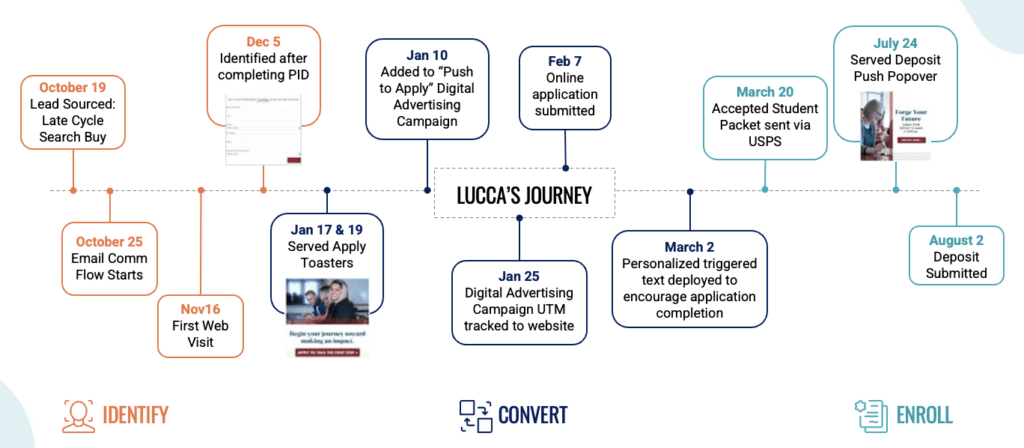

No. 3 – Let’s get personal and Focused: Communicate based on behavior not just a drip campaign

When we discuss behavioral interactions, we are discussing the ability to measure what the student is experiencing with your digital strategy. This is how we determine their needs and their next steps … and it requires a personalized and focused message strategy. This is different from what even the best CRMs provide.

We start with the admissions office receiving a Daily Visitor report; each counselor receives their particular student interactions with your website and other digital assets. Based on what the student did, we can send an email, engage with dynamic content on the website, or even serve a digital ad to that student with a specific message. This focused approach to communications helps cut through the noise and reach students and their families with relevant, helpful information.

Takeaways

Build your affordability and value brand messaging. Examine data to understand how your families are paying for college and ensure your financial aid messaging matches their needs.

Provide strong financial aid messaging across many channels to many audiences. Know who to connect with to build relationships that are necessary to influence those who have the attention of your prospective students.

Connect with Relevant Messages Based on Behavior. Create a personal student digital experience by using behavioral data to inform what the next message should be.

I hope you found Part 1 of Capture’s new blog series, Promoting Your Institution’s Value Propositions, informative and helpful. Upcoming installments will look at communicating your Authenticity, Adaptability and Accessibility. Stay tuned!

By Christopher Harris Ed.D., Senior Enrollment Strategist, Capture Higher Ed